The Post-Sanctions Economic Developments in Iran

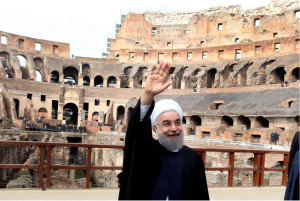

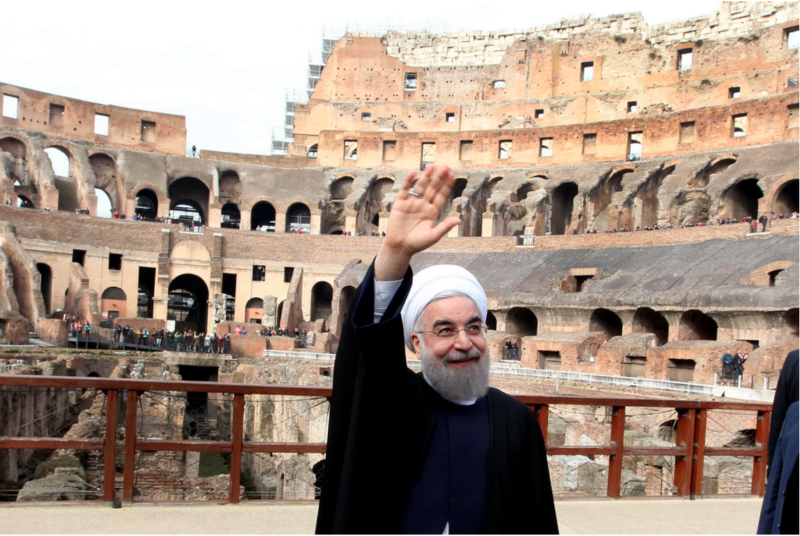

Lifting sanctions was among one of the most important promises of Hassan Rouhani’s presidential election campaign, a promise that was fulfilled following 26 months of intensive nuclear negotiations.

The removal of sanctions will create openings and business opportunities for Iran’s economy that will improve Iran’s overall economic outlook.

This article reviews the impact that sanctions relief will have on 8 key sectors of the economy:

The Banking and Financial Sector

The most visible impact of sanctions relief will be in Iran’s banking and financial sector. Lifting sanctions will generate significant benefits for Iran’s financial system:

A: Release of Iran’s blocked assets: Sanctions relief will lead to the release of about $30 billion worth of Iran’s funds; the government will hold $6 billion and a part of the funds will return to the Central Bank’s treasury. The government has already borrowed and spent this fund in advance. American officials and the press had a different assessment and initially claimed that $100 billion will be freed, but Iranian officials indicate that foreign governments are holding the rest of the funds as a guarantee for the implementation of certain finance projects. Moreover, information about the funds that are blocked in some countries like Britain has not been published. When commenting on the figure of the country’s blocked assets, Iranian state officials have brought up different numbers, which has sparked criticism.

Iran also managed to resolve a legal file that goes back to the late Shah (Mohamad Reza Pahlavi) era and his advance payments for the purchase of arms from the US. The payment was about $400 million; after 37 years ultimately about $1.7 billion (interest included) will be reimbursed to Iran.

B: Connecting Iran to the Swift Network for interbank transactions – Sanctions relief will facilitate international banking transactions for the government and the private sector and ultimately one of the largest impediments for international trade and business with Iran will be removed. In previous years, some business transactions were conducted in cash, but problems had emerged.

C: Opening letters of credit for trade will be normalized – In the past few years, Iranian businesses that had not been able to benefit from opening letters of credit were forced to pay a higher price for purchasing goods. While letters of credit may now be issued to Iranians, only 1000 individuals applied for credit and product purchases on the very first day of sanctions relief.

D: Access to monetary sources in international markets – Industry leaders, government companies, and businesses are now able to apply for short-term, mid-term and long-term credit in order to purchase goods and services.

E: Iranian and International Banks issue guarantees for the import and export of goods to and from Iran – With the elimination of banking and financial sanctions, the price of importing goods will drop at least 10% to 12%, and the cost of basic materials will be reduced, and become less expensive for factories to produce.

Transportation and Insurance Sector

With the removal of sanctions in the transportation and insurance sectors, Iran’s economy will benefit from the following economic opportunities:

A: Iran will be able to purchase aircraft and have access to spare parts, technical services, and aircraft inspection services – even services offered by American companies. As a result of such developments, Iran will be able to renew its aging and depleted air fleet and elevate the safety and security of its flights.

B: Iranian aircraft will have full access to airport services in European countries, and a number of European airlines will resume their flights to Iran.

C: Credible international insurance companies will offer coverage for the ships and cargo that are heading to Iran. While sanctions on the shipping industry were lifted two years ago, major insurance companies were refraining from issuing insurance for ships carrying goods and cargo to Iran.

Energy Sector

A: The Sale and Marketing of Oil, Gas, and Petrochemical Products – With lifted sanctions, the government’s restrictions on determining the oil sale ceiling will be removed and the state will be permitted to sell its products in any volume and to any country selected by state officials. The Iranian government has announced that it can supply the market with at least 500,000 barrels more than current levels. In addition, no restrictions will be imposed on the sale of Iran’s gas resources and petrochemical products. The sanctions that were imposed on Iran’s petrochemical products were removed two years ago at the time the nuclear negotiations ramped up.

B: Investment in the Energy Sector – Iran has a dire need for foreign investments in the energy sector. The absence of sufficient financial resources, the depletion of oil wells due to wasteful extractions and exploration of new oil and gas fields, as well as the completion of unfinished projects such as South Pars require new foreign investments. The energy sector is one of the most important parts of Iran’s economy, and major oil companies have shown an increasing interest in investing in it in the post-sanctions period. In order to facilitate such investments and attract the attention of foreign companies, Iran’s Oil Ministry has reformed the conditions of contracts and agreements in a way that would benefit investors. Opposing factions of the government have harshly reacted to such changes, and hardline opponents have called the changes treason, arguing that the changes put the country’s resources on sale and ‘betray’ Iran. It is worth mentioning that lifting sanctions on the oil sector does not include American oil companies because of the 1995 sanctions in which US companies were prohibited from investing in Iran’s oil and energy sector. Investments that are conducted outside the US and are under non-American management teams are an exception to these restrictions.

Goods and Products Transactions Sector

The existing bans on Iran’s imports and exports will be removed once the sanctions are lifted, and the sale of a large number of products and goods will be permitted that had previously been banned by the United Nations, the United States, and the European Union. A big portion of these products are sensitive items that often have dual use (including items needed in the medical industry).

Industry and Service Sector

A: Foreign Investment in Industry and Transfer Technology – Representatives from a large number of companies have traveled to Iran and tested the waters in order to assess the climate for investment and technology transfers in non-oil sectors of Iran’s economy. It seems that the auto sector has to some extent been able to attract the attention of foreign investors. Consequently, agreements have been signed with Germany and France in this sector.

Due to economic and political problems, Iran’s private sector has not been able to gain sufficient confidence and trust to invest in Iran’s economy. Since foreign companies prefer to step into enterprises in these sectors with an Iranian partner, the path to attract such investments is currently facing a number of challenges. The results of the Majlis elections and the way that the powerful ruling bodies interact and cooperate after the election will have a determining impact for confidence building and attracting investment in these sectors.

B: Engineering and Educational Services: Lifting sanctions will provide work opportunities for foreign companies that offer consulting and engineering services. In addition, sanctions had caused challenges for Iranian companies that used to offer technical and engineering services to other countries. These companies often faced challenges to receiving financial compensation for contracts. but now they will be able to avoid such barriers and cash out the funds for the contracts that they had performed in the past.

The sanctions in the education sector will be eliminated. Iranian students once again will be able to study in fields related to nuclear research. Western universities will also be able to open educational offices in Iran (while this issue was not directly mentioned in the sanctions, banking restrictions and political complexities had barred western universities from offering educational courses in Iran).

Defense and Arms Sector

In the past few years, Iran’s defense and arms sector had been subject to wide-ranging sanctions. With prior notice to the United Nations Security Council (UNSC), Iran will be permitted to purchase conventional arms for 5 years, and, after this period, Iran will enjoy complete freedom to trade arms and defense equipment. In terms of missile system development, Iran has an 8-year restriction. The text of the UNSC resolution, however, is not under Chapter VII of the United Nations charter. Iran has a total ban on the trade and use of ballistic missile systems.

Nuclear Energy Sector

Lifting sanctions on the peaceful nuclear energy sector will pave the way for the development of new nuclear power plants, research reactors, and the most developed facilities in the global nuclear industry. Maintaining the safety of power plants is the most important and crucial issue in the nuclear industry. Iran is currently employing Russian inspectors for this purpose, something that elevates the risk of conflict between the interests of countries that develop nuclear power plants and Russia, the country that currently sends inspectors to Iran. With the elimination of sanctions, Iran will be able to take advantage of other countries’ services in this regard.

Individuals, Organizations, and Institutions

The names of hundreds of natural and legal individuals (in both the public and private sectors) are going to be omitted from sanctions. In addition, sanctions that had been imposed on many public institutions and organizations, including some Iranian banks, shipping companies, and a number of airlines – organizations and institutions which had sustained extensive and substantial financial losses under sanctions – are also going to be eliminated.